we are the D2C brand global logistics solution provider

How to make a basic product with simple uses become a popular trend, ignite social media, and have a large number of brand followers?

Recently, the Stanley “Big Head Ice Cup” that has become popular overseas has given brand Ark a unique opportunity for the birth of a popular single product.

So far, Stanley Ice Cup has accumulated over 1 billion views on TikTok. On Amazon, Stanley Ice Cup’s monthly sales have remained stable at over 30000. In 2023, Stanley Ice Cup sales increased by 275% year-on-year, and its best-selling hydration category also saw a sales increase of 215%, making it an unquestionable top brand in this category.

But this cup was actually launched as early as 2016, but its sales have been sluggish and it was close to being taken down, until it became popular on social media in recent years.

How did the Stanley Ice Cup achieve a comeback from sluggish sales and imminent delisting to global popularity within a few years?

How did Stanley, as a company with a history of 110 years, transform and expand its customer base to become one of the most popular beverage brands today?

Transformation positioning in the female market

Stanley now appears as a popular young brand image in the female market, while in its early years, it was a popular male style outdoor brand among military and outdoor professionals. How did the brand transform its rugged image, attract a wide range of female customers, and integrate its products into their daily lives?

William Stanley, the founder of Stanley, invented steel vacuum sealed bottles in 1913. Since then, Stanley water bottles have become a landmark product in the vacuum bottle and thermos categories, and an important lifestyle brand that encompasses scenarios such as work commuting, road travel, and outdoor exploration.

Stanley initially targeted outdoor audiences such as workers, camping, and hiking. In 2012, Stanley also promoted its products that resonated with “30 year career veterans” and “retired Army soldiers.”.

In 2016, Stanley’s new product, the Stanley Quencher thermos, completely changed Stanley’s market positioning. Stanley Quencher’s sales were not ideal in the early stages of its launch due to market audience and promotional issues. In 2019, Stanley even wanted to take down this product to solve the problem of failed new product launches.

At this point, the three founders of the online blog and Instagram account TheBuyGuide, Linley Hutchinson, Ashlee LeSueur, and Taylor Cannon, saw the potential of this product in the female market.

After discovering the product, they quickly recommended it as one of the flagship products on TheBuyGuide’s purchasing guide. Fans of TheBuyGuide also gave positive feedback on this thermos and facilitated a wholesale order project.

TheBuyGuide has launched Stanley Quincher’s group buying program online, with a minimum order quantity of 10000 cups. The group buying plan received enthusiastic feedback as soon as it was launched, with the first 5000 cups sold out within four days and the second 5000 cups sold out within an hour of being re listed.

Stanley Quincher’s popularity on TheBuyGuide surprised the Stanley brand department and led them to re-examine the value and potential of Quincher’s products. Stanley executives contacted TheBuyGuide and obtained purchase data from TheBuyGuide. 97.7% of Stanley Quencher’s group purchase orders were female, with the oldest being women aged 35 to 44, and almost 100% of fans aged 25 to 45.

The BuyGuide states, “No brand in the world can achieve good marketing goals without targeting the female user group aged 25 to 50, even if you are a men’s clothing brand – if you don’t find a way to talk to women aged 25 to 50, you can’t focus on marketing because women are often the main purchasing force of the brand. They buy for their families, for their husbands, and for the business.”

Afterwards, Stanley began to shift her strategy, shifting her focus from early outdoor audiences such as workers, camping, and hiking to urban women who love fashion and exquisite living.

Scenario based marketing for popular TikTok

1.Creating the “Stanley Cup” craze through social media marketing

Since shifting the consumer base towards urban women, Stanley’s marketing approach has undergone a disruptive style shift.

Stanley’s success on TikTok is mainly attributed to the brand’s willingness to listen to the public’s advice and opinions: after obtaining good indicator data from TheBuyGuide, Stanley immediately began conducting research on the content discussed by women on social media and the reasons why women like this cup.

After conducting audience research, Stanley released multiple collections in different colors, finishes, and patterns, some of which collaborated with brands such as Pendleton and Target’s Heart and HandrightMagnolia collections. In order to stimulate more people’s interest in new products, Stanley has also adopted a “drops” product strategy, which means the company releases limited edition products without any warning as a purchasing model to attract Generation Z consumers.

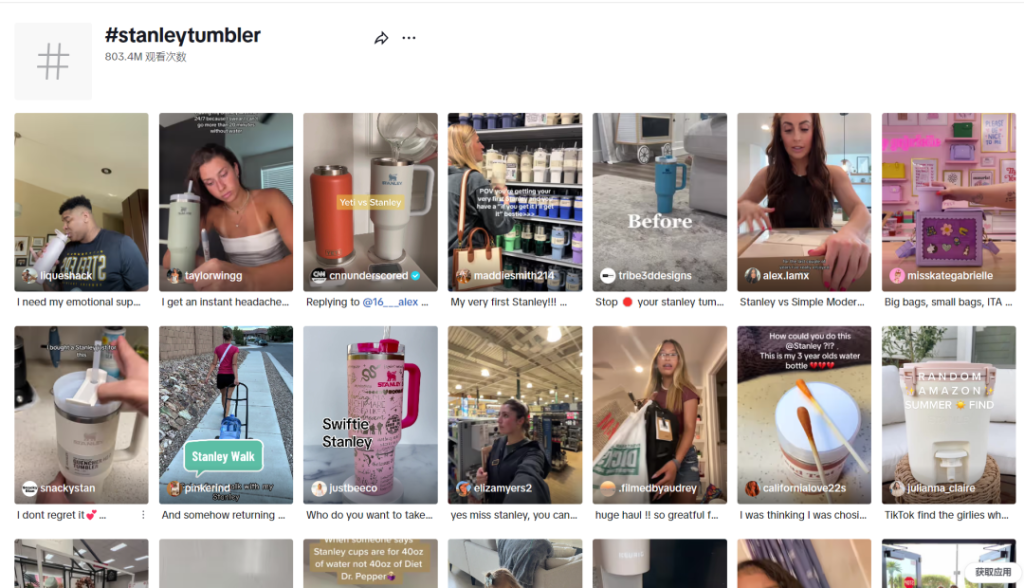

Transforming from an ancient practical lifestyle brand to a new brand that attracts Generation Z trendsetters and sophisticated consumer women. Stanley said, “On social media platforms like TikTok, our consumers have to some extent replaced the brand itself. On TikTok, # Stanley Tumbler has seen 800 million views, while # Stanley Quencher has seen 180 million views. Most of the video content is created and published by consumers themselves.”

For water cup products, a total tag view of 1 billion is an astonishing number. Stanley not only successfully promoted to a popular internet celebrity brand, but also reached a gap in discussion and playback among similar products.

2. Collection habits and water consumption trends after the epidemic

In addition to his enthusiastic performance on social media, the change in consumption habits after the epidemic has also contributed to Stanley’s popularity.

Since the outbreak of the pandemic, research has shown an increase in the number of global consumers collecting items. At the same time, consumers are increasingly inclined to purchase health and wellness products (including hydration) after the epidemic.

People have also discovered the use of Stanley in different scenarios and fields – Stanley Quencher can be used for morning coffee, exercise, pairing with different clothing, and even for decorative stickers.

The appeal of Stanley Quencher is not only due to the good performance of the product, but also to its appearance and the customer’s experience when using it. The Stanley Cup boasts mature industrial technology brought by a century old brand. It not only has an ergonomic handle and a cup holder that can be firmly installed, but its colorful colors also meet the emotional needs of contemporary consumers.

In the consumption iteration, cups not only appear as a water bottle, but also as a matching accessory for people going out. Stanley said, “A brand or product that truly resonates with consumers can only be perfectly combined to meet their technological, functional, and emotional needs. If you miss any of these needs, it will seriously affect usability, user experience, or emotional connection.”

Social media has also driven people’s desire to collect items. When a product becomes a popular item, its functional attributes not only include the functions of the product itself, but also include social media attributes. For Stanley, collecting Stanley water cups will receive a lot of popularity from social media users, which also promotes Stanley’s brand community awareness. As a Stanley user, you are easily seen, heard, and affirmed.

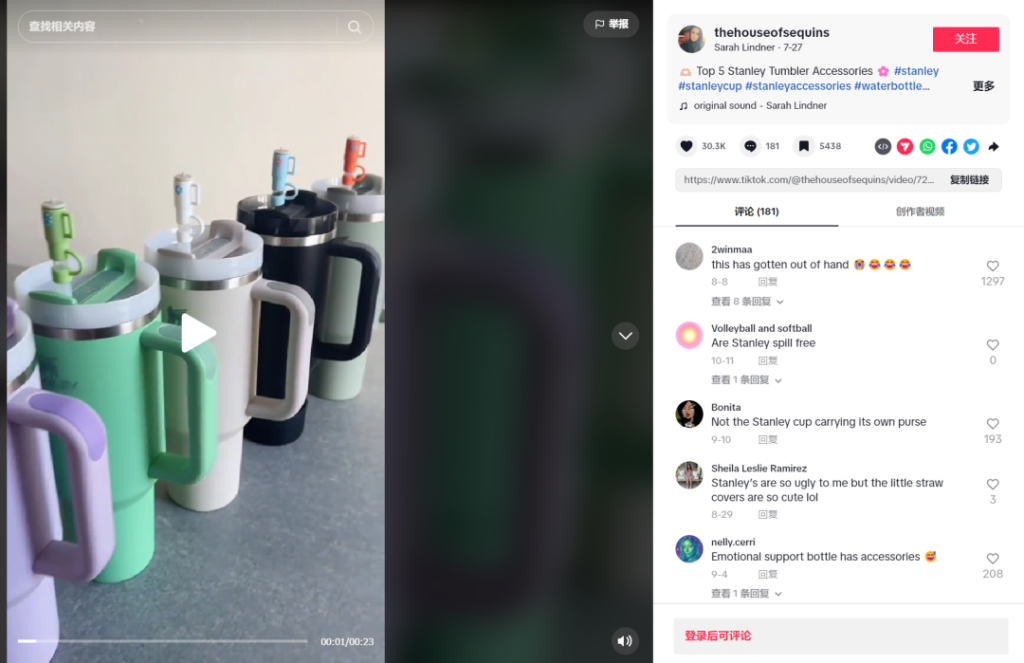

TikTok user @ heouseofsequins showcased her collection of over a dozen Stanley Quencher glass cups in different colors and sizes in the video, earning 30000 likes, 5000 favorites, and a maximum of 2000 likes in the comment section. The social media interaction brought about by TikTok’s explosive trend is difficult for other products to achieve.

In 2023, Stanley’s Quencher sales increased by 275% year-on-year, and its best-selling hydration category sales also increased by 215%. As of 2023, Stanley has firmly established its position as the top beverage brand in North America in terms of financial performance.

However, there are also many water bottle brands on the market that were once sought after as “popular” items: Nalgene, CamelBak, S’well, and even HydroFlask were once popular and replaced by new popular items. Can Stanley consolidate his leadership position in this field?

The advantage of Stanley’s brand is that even if the market is always crowded and there is no shortage of new product lines. But as a century old brand, Stanley uses flexible decision-making methods to quickly adapt to the current market situation and is good at listening to consumer voices. When Stanley has female consumers discussing on social media, Stanley quickly launches a product line targeting them and listens to their needs.

Do you need a FLAWLESS B2C/D2C FULFILLMENT company?

We help you through the PRE-PURCHASE stage. Check the PRODUCT QUALITY. And store your products in our warehouses before final Shipments.

Get HIGH CUSTOMER satisfaction with our Timely Delivery.