On June 12, 2023, Instant Brands, the parent company of the famous North American home appliance brand Instant Pot, filed for bankruptcy.

Many media outlets attribute the bankruptcy of Instant Brands simply to a decline in sales.

However, the decline in sales is just a superficial phenomenon and not the root cause.

For this reason, I conducted a detailed analysis of Instant Brands’ product line and found that the root cause of its bankruptcy lies in:

Missed the best opportunity for diversification and made continuous product selection mistakes during diversification.

1.Three insights on Amazon’s product selection

1) The product line should be diversified in a timely manner

As a small kitchen appliance, Instant Pot is not a completely essential product.

Instant Brands expect Instant Pots to continue to grow and remain popular, which is not very realistic and very dangerous.

For a long time, Instant Brands has relied heavily on a single product line and failed to seize the best opportunity for diversification, laying hidden dangers for bankruptcy.

2) Diversification of product lines requires both a clear understanding of trends and reliance on one’s own advantages

Starting from early 2021, Instant Brands began to launch coffee machines, air fryers, air purifiers, and mixers on Amazon, attempting to diversify their products.

However, apart from the success of the air fryer, all other attempts at diversification have failed.

This article will provide a detailed analysis of the success and failure of these products, without further elaboration.

3) Maintain sensitivity to changes in demand

For non essential small household appliances, consumers are prone to being fond of the new and even moving on to other things.

The decline in consumer search for electric pressure cookers has been around since 2018.

Instant Brands only saw short-term sales growth, but ignored the long-term downward trend, making the wrong strategic decision.

2 Air fryers, why can they succeed

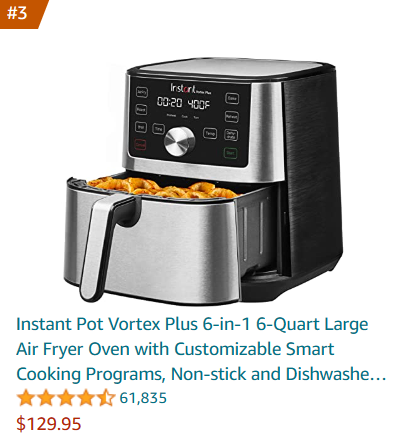

According to the Amazon Best Seller ranking, Instant Brands has a total of 4 products in the top 20, with the best performing product ranking third.

There are three main reasons why air fryers can succeed.

1) Air fryer highly correlated with Instant Pot

Air fryers, like Instant Pots, are kitchen cooking appliances with almost the same user and fan base.

With the powerful influence of Instant Pot, air fryers are naturally easily accepted and loved by its fans.

2) The health concept of air fryers

The biggest feature of air fryers is that they are oil-free or have less oil, which is in line with the current popular concept of health.

Therefore, air fryers have quickly gained the favor of consumers, and their popularity and trend are both on the rise.

3) Promotion of COVID-19

During the epidemic, consumers have increased opportunities and time to stay at home and cook.

This has played a promoting role in the popularization of air fryers.

The air fryer once became one of Amazon’s most popular small home appliances.

- Why did the coffee machine fail

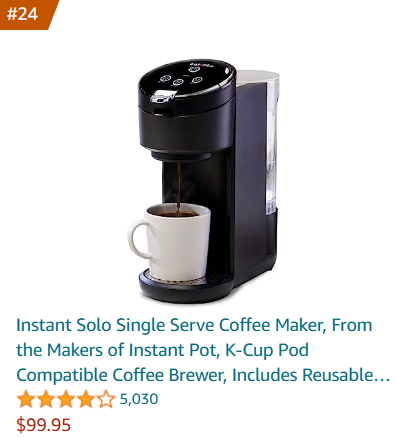

According to the Amazon Best Seller ranking, Instant Brands ranked 24th in terms of products, with sales of approximately 100 units last month.

For small and medium-sized sellers, this ranking may be quite good.

However, for big sellers, this ranking is not considered successful.

Similarly, let’s analyze the reasons:

1) The correlation between coffee machines and Instant Pot is not high

The coffee machine, although also a kitchen appliance, is not highly correlated with Instant Pot.

Fans of Instant Pot cannot easily build trust and purchase coffee machines.

2) The industry is highly competitive and there are many globally renowned brands

The market capacity of coffee machines, although large, is highly competitive.

Competitors gathered forces such as Cuisinart and Mr Global renowned home appliance brands such as Coffee, Hamilton Beach, and Keurig.

Especially Keurig, who holds the K-Cup patent, almost monopolizes the capsule coffee machine market in the United States.

Instant Brands entered the coffee machine market without any advantage, and I believe it was a directional mistake.

- Why does the air purifier fail

According to the Amazon Best Seller ranking, Instant Brands ranked 38th in terms of products, with sales of approximately 600 units last month.

Due to the large market capacity of air purifiers, the monthly sales of 600 units are somewhat insignificant compared to the top ten thousand units on the list.

Analyzing the reasons, there are mainly two points:

1) The air purifier is completely unrelated to the Instant Pot

Air purifiers, although small household appliances, do not belong to kitchen appliances.

Fans of Instant Pot are unable to trust the air purifier and form a purchase.

2) Chinese sellers have an absolute advantage

The leading enterprise in air purifiers is the Chinese brand Levoit, with its parent company being Chenbei.

In addition to Levoit, there are also many small and medium-sized sellers from China.

These Chinese sellers, relying on China’s strong supply chain, have a huge competitive advantage in terms of cost and quality.

Squeezing globally renowned air purifier manufacturers such as Blueair, Honeywell, and Winix out of the top 10 on the list.

Instant Brands, blindly entering the air purifier category where Chinese sellers have an absolute advantage, naturally cannot benefit.

5.Why vertical mixers fail

According to the Amazon Best Seller ranking, Instant Brands ranked 67th with sales of approximately 50 units last month.

I personally believe that choosing to enter this category by Instant Brands is an extremely wrong directional issue.

The reason analysis is as follows:

1) The correlation between vertical mixer and Instant Pot is not high

Although a vertical mixer is also a kitchen appliance, it is not a cooking tool, but a tool for preparing ingredients.

Therefore, although there is a correlation between vertical mixers and Instant Pot, the correlation is not high.

2) The market capacity is very small

Vertical mixers have a relatively small market capacity, with a total monthly sales volume of approximately 40000 units.

Compared to air fryers, air purifiers, and coffee makers mentioned earlier, vertical mixers are clearly a niche market.

3) Top companies are globally renowned home appliance brands

The top companies in this category are globally renowned home appliance brands.

Low end brands include Dash, with product prices ranging from $40 to $50.

Mid range brands include Hamilton Beach and Cuisinart, with product prices ranging from $100 to $200.

High end brands include KitchenAid, with product prices ranging from $300 to $600.

Both in terms of market capacity and market competition, it is not suitable for new big sellers to enter.