Before starting your international shipping, you need to understand ddp shipping terms,

what ddp shipping terms is

DDP (Delivered Duty Paid) is delivered after duty paid.

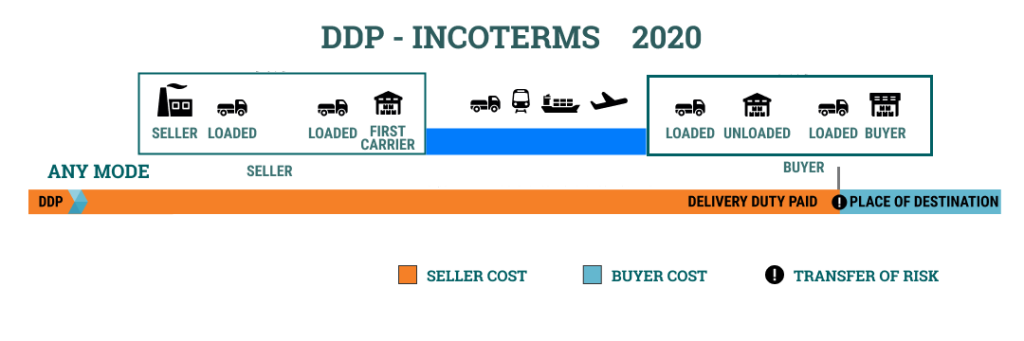

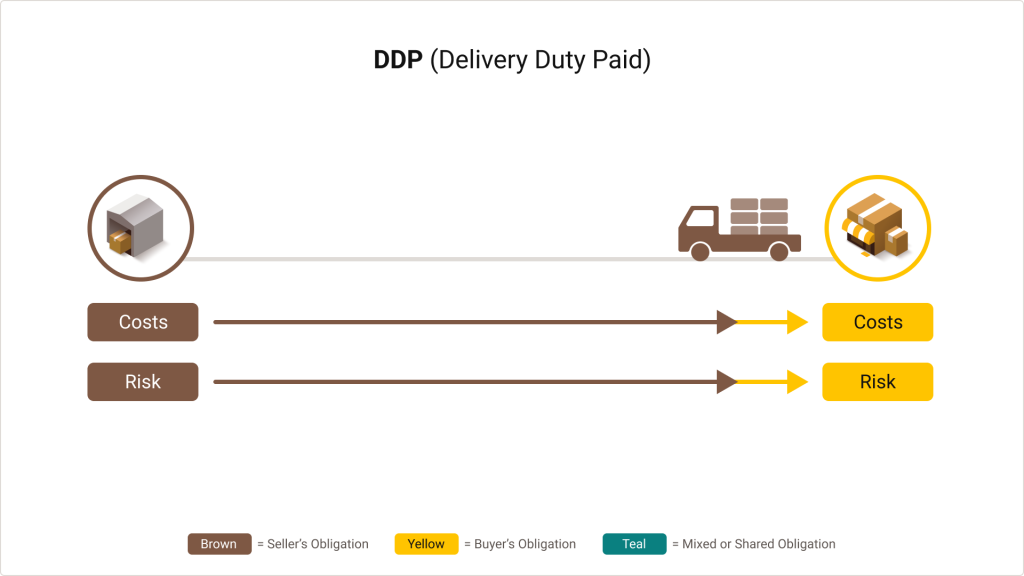

DDP is a term in which the seller bears the greatest risk, responsibility and expense among the 13 trade terms included in the General Principles 2000.

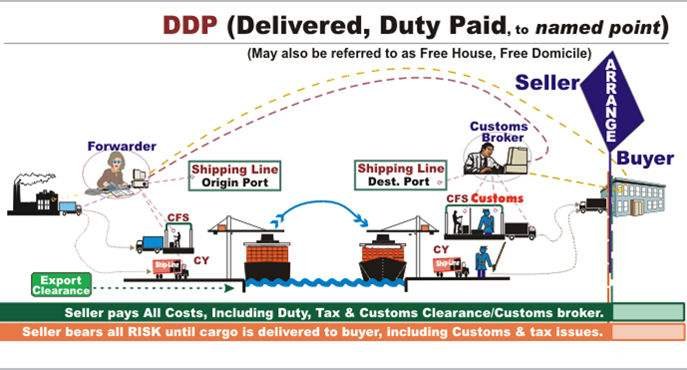

Specifically, it means that the seller is responsible for transporting the goods from the place of departure to the designated destination in the country of import specified in the contract, and the delivery is completed only when the goods are actually delivered to the buyer. The seller must bear all risks and costs of transporting the goods to the designated destination, including any “taxes” that should be paid at the destination when customs procedures are required (including the responsibility and risk of customs procedures, as well as the payment of handling fees, duties, taxes and other charges).

The seller bears the minimum liability under the EXW term, while the seller bears the maximum liability under the DDP term. This term should not be used if the seller cannot directly or indirectly obtain an import license.

However, if the parties wish to exclude from the seller’s obligations all charges payable on any import (such as VAT), this should be expressly stated in the sales contract. If the parties want the buyer to bear the risks and costs of importation, the term DDU should be used.

The DDP term is the one in which the seller bears the greatest responsibility and costs the most among the 11 trade terms. It means that the seller goes through the import customs clearance procedures at the designated destination and delivers the goods that have not been unloaded on the transport vehicle at the delivery location. With the buyer, complete delivery.

The seller must bear all risks and costs of transporting the goods to the designated destination, including any “taxes” that should be paid at the destination when customs procedures are required (including the responsibility and risk of customs procedures, as well as the payment of handling fees, duties and taxes). , taxes and other charges).

This term should not be used if the seller cannot directly or indirectly obtain an import license. However, if the parties wish to exclude from the seller’s obligations all charges for importation (such as value-added tax), this should be expressly stated in the sales contract. This term applies to all modes of transportation.

The main obligations of the seller under DDP terms

(1) The seller must provide goods and commercial invoices or equivalent electronic information that comply with the provisions of the sales contract, as well as other certificates that may be required by the contract to prove that the goods comply with the provisions of the contract.

(2) The seller must obtain any export licenses and import licenses or other official permissions or other documents at his own risk and expense, and handle all customs procedures required for transit from other countries, and pay duties and other related fees.

(3) The seller must hand over the goods that have not been unloaded on the delivery vehicle to the buyer or other person designated by the buyer at the designated destination on the agreed date or delivery period.

(4) The seller must bear all risks of loss or damage to the goods until the goods have been delivered in accordance with the regulations.

(5) The seller must provide the buyer with delivery documents, shipping documents or equivalent electronic messages at his own expense.

The main obligations of the buyer under DDP terms

(1) The buyer must pay the price in accordance with the sales contract.

(2) At the seller’s request, at the seller’s risk and expense, the buyer must provide the seller with all assistance to help the seller obtain the import license or other official permission required for the import of goods when customs procedures are required.

(3) The buyer must bear all risks of loss or damage to the goods from the time of delivery as specified.

(4) Once the buyer has the right to determine the time within the agreed period and/or the point at which the goods will be received at the designated port of destination, the buyer must give the seller sufficient notice of this.

(5) The buyer must accept the bill of lading or shipping document provided in accordance with regulations.

(6) The buyer must pay for any pre-shipment inspection, except for inspections mandated by the relevant authorities of the exporting country.

Points to note in actual international trade and international logistics business

A. Under the delivery conditions of DDP, the seller delivers the goods at the designated destination after going through export customs clearance procedures. This actually means that the seller has transported the goods into the importer’s domestic market.

If the seller has difficulty directly handling the import procedures, the seller can also ask the buyer to assist in the process. If the seller cannot directly or indirectly obtain import licenses or handle import formalities, the term DDP should not be used.

B. If the parties wish to exclude from the seller’s obligations certain charges that need to be paid when the goods are imported, such as value-added tax, they should add words to this effect, such as “delivery after duty paid, value-added tax unpaid (insert designated destination)” )” to make it clear.

C. Unloading costs: The buyer is responsible for unloading the goods from the arriving transportation vehicle at the designated destination, but the seller must ensure that the goods are available for unloading. When signing a transportation contract, the seller should pay attention to the coordination of the delivery location related to the transportation contract and the sales contract.

If the seller incurs unloading expenses at the designated destination in accordance with the transportation contract, the seller has no right to demand reimbursement from the buyer unless otherwise agreed by both parties.

D. Risk avoidance: The seller has no obligation to enter into an insurance contract with the buyer, but since the risk of the entire transportation process is borne by the seller, the seller usually avoids the risk of cargo transportation through insurance.

Understanding DDP terms will enable you to operate confidently and efficiently in the global trade world.