Revenues of Vietnam’s four major e-commerce platforms surge, with Shopee becoming the biggest winner

Vietnam e-commerce platform GMV ranking announced

Digging into the high-growth Vietnamese e-commerce market, who is the most popular e-commerce platform among consumers?

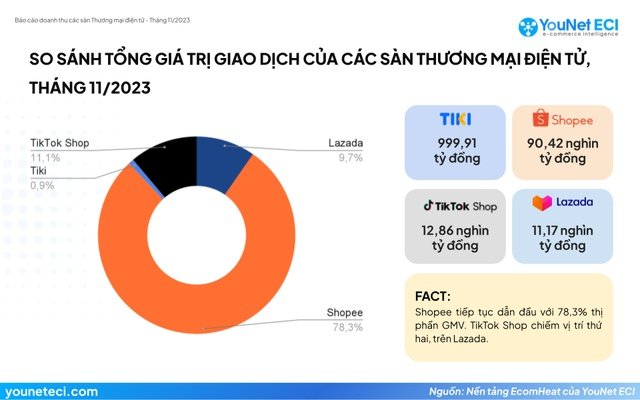

Sales speak for themselves. According to the latest report released by YouNet ECI, an e-commerce data analysis company, in November 2023, affected by the boosting effect of popular promotions such as Double 11, Black Friday, and Cyber One, the four major e-commerce platforms of Shopee, Lazada, Tiki, and TikTok Shop In Vietnam, incomes have soared.

Overall, more than 1 million sellers on the four major platforms sold a total of 967.27 million products in November, and the gross merchandise volume (GMV) reached 115.45 trillion VND, an increase of 1.6 times compared with the same period last year. Among them, Shopee’s performance is the most eye-catching.

In GMV market share, Shopee is far ahead with a share of 78.3% (equivalent to 90.42 trillion VND), and its dominant position in the Vietnamese market has once again been demonstrated. After Shopee, TikTok Shop ranked second with a share of 11.1%, followed by Lazada and Tiki, which held 9.7% and 0.9% shares respectively.

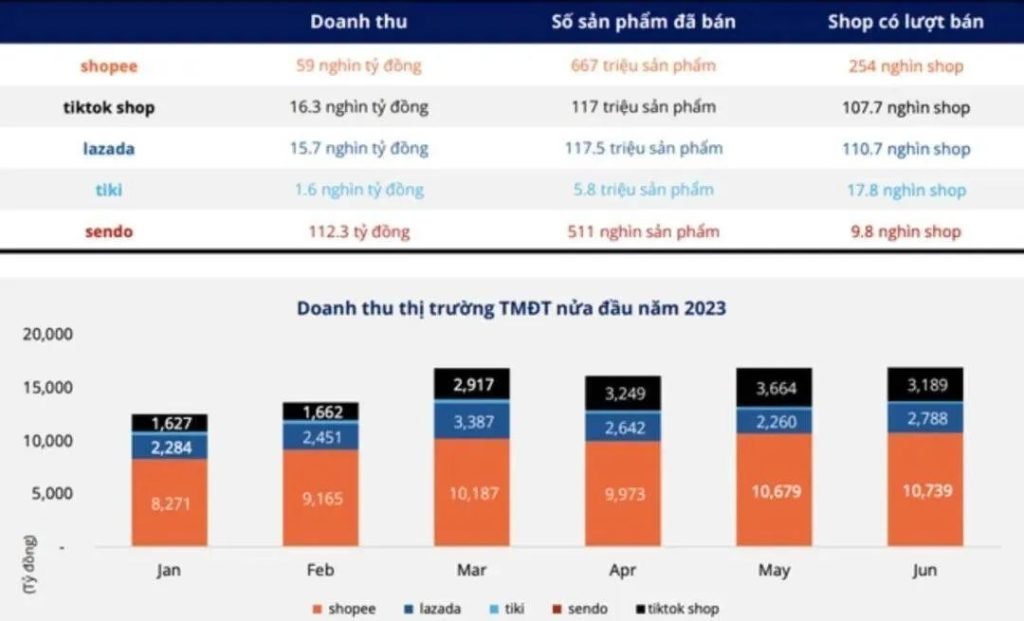

To a certain extent, this GMV ranking reveals changes in the competitive landscape of Vietnam’s e-commerce platform market. Although it only started to expand into the Vietnamese market in 2016, Shopee’s dominant position has always been very solid. Just like in April this year, Metric released the revenue report of Vietnamese e-commerce platforms in the first quarter of 2023.

The report shows that Shopee’s total revenue reached 24.7 trillion Vietnamese dong in the quarter, still occupying the largest market share. It is worth noting that Lazada has since ranked second with a total revenue of VND7.5 trillion, and TikTok Shop has ranked third with a total revenue of VND6.0 trillion. Obviously, this is not the same as the market share ranking in November this year.

Competing for market share

In November 2023, TikTok Shop successfully surpassed Lazada in market share and ranked second. Although the data is only for one month, it is enough to illustrate the strong rise of TikTok Shop in the Vietnamese market.

“Social e-commerce is very popular in Vietnam. Vietnamese consumers spend an average of one to two hours a day on TikTok, chatting, shopping, and documenting their lives… They have placed 1 to 2 million orders through the platform.”

As TikTok Vietnam representative Nguyen Lam Thanh said, taking advantage of the trend of social e-commerce, TikTok Shop Vietnam’s sales have continued to rise, making it a rising “new star” in the Vietnamese e-commerce market.

With such rapid growth momentum, TikTok Shop has successfully shaken the market position of the second-largest company Lazada. The report shows that in the first half of 2023, TikTok Shop will catch up with Lazada in revenue share and become the second largest e-commerce platform in Vietnam. It is not difficult to imagine that after enjoying the benefits, TikTok Shop will continue to increase its efforts in the Vietnamese market. However, at present, it is difficult for TikTok Shop to catch up with Shopee in a short period of time.

Over the years, many giants such as Shopee, Lazada, TikTok Shop, etc. may have seen the great potential and development prospects of Vietnam’s e-commerce market, and they have rushed to actively deploy. According to Statista’s predictions, Vietnam’s e-commerce market will reach US$60 billion by 2030, and is expected to become the second largest e-commerce market in Southeast Asia, second only to Indonesia.

Along with this trend, the Vietnamese market has become even more popular in the eyes of many e-commerce giants eager to grow. Looking at the Vietnamese e-commerce arena, in addition to old players such as Shopee, Lazada, Tiki, and TikTok Shop, there will also be new players like Temu entering the market in 2023. In addition, Amazon continues to accelerate its expansion into the Vietnamese market.

In the future, the Vietnamese e-commerce market structure will be unpredictable, and all kinds of competition will definitely become more intense. Therefore, sellers who want to continue to develop in this market not only need to work hard to improve their own strength, but also need to maintain a keen insight into market changes and be flexible.

If you are considering expanding into new markets, xcjd logistics services can help. As an experienced NVOCC, we will help you every step of the way with the latest customs expertise, visibility and communication capabilities.