The proportion of capacity deployment by large shipping companies in major ports is a two-way choice. Ships can be freely dispatched, and ports are indeed fixed. In the context of different global economic conditions and economic environments in different countries, which ports are preferred by large container shipping companies to dock?

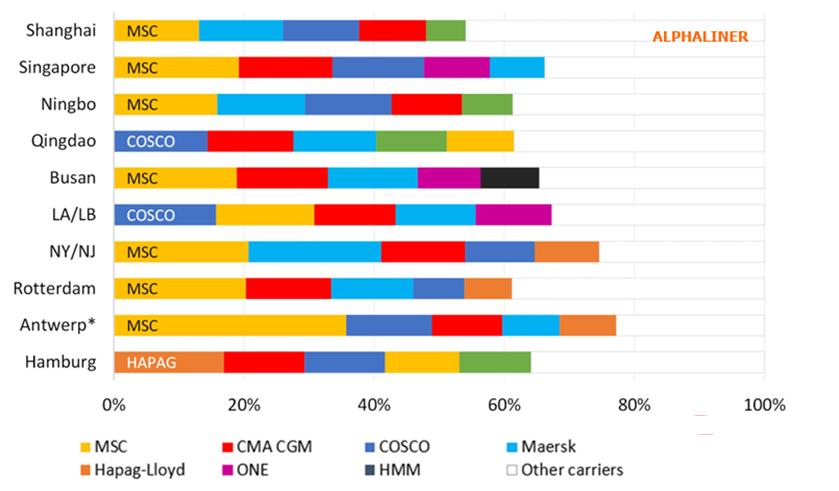

In the first three quarters of 2023, shipping companies from the top ten major ports around the world listed their share of transportation capacity, which is not equal to cargo volume but has a positive correlation.

It is only natural that the mother ship should dock at its home port.Among the top ten major container ports in the world, the ship capacity and call status of major liner companies,MSC, the world’s largest liner company, is the largest customer of most major container ports, and the German company Hapag-Lloyd leads the way in the Port of Hamburg, Germany.

For example, the Port of Los Angeles and Long Beach in the western United States has become the “home field” of COSCO Shipping. The American shipping company Matson Shipments has a small volume and can be ignored.

Which port do large container shipping companies prefer?

In fact, among the top ten ports, only in the Port of New York and New Jersey, the ranking of the transportation capacity share of the major shipping companies calling ships is consistent with the ranking of the shipping companies’ total transportation capacity. Therefore, if you look closely at this table, you can see the operating strategies and symbiotic relationships of many ports and shipping companies.

The first thing to note is that Alphaliner did not select ports based on container throughput rankings (otherwise they might all be Chinese and East Asian ports). Instead, it chose Qingdao Port and Busan Port in Northeast Asia, and Shanghai Port and Ningbo Zhoushan Port in the Yangtze River Delta.

The Port of Singapore in Southeast Asia, as well as the three major European ports of Rotterdam, Antwerp, Bruges, and Hamburg, as well as the Port of Los Angeles, Long Beach, and the Port of New York and New Jersey in North America, are the main gateways for East-West trade, and diversified data can provide a more comprehensive Reflects the mutual choice between ports and shipping companies. (Shenzhen Port is also an important foreign trade port, but it may be limited by the large differences between port areas and the difficulty of integrating data, so it was not selected.)

In addition, due to the existence of the shipping alliance, some ships in the ship data tracked by Alphaliner are also Carrying cargo for other alliance members or space lessees, but choosing to call a certain port illustrates the importance of that port in its route network for the shipping company.

One of the important factors affecting the share of shipping companies calling ports is the size of the shipping company, so MSC dominates the list. Maersk, CMA CGM, and COSCO Shipping rank among the best in almost all major ports. Another factor is also obvious, that is, a country’s shipping companies have favorable geographical locations in ports in the country and neighboring regions.

For example, Hapag-Lloyd ranks fifth in the world in terms of shipping capacity. In the figure, the share of shipping capacity of ships calling at most ports does not reach the top five.

However, it is the largest customer of the Port of Hamburg, and has also entered the top 5 of other ports in Northern Europe and the Port of New York and New Jersey on the other side of the Atlantic. HMM (8th in the world) has become the 5th largest customer of the Port of Busan, and COSCO Shipping (4th in the world) ) are respectively the second largest customer of Shanghai Port and Ningbo Zhoushan Port and the first largest customer of Qingdao Port. The same reason is why Evergreen (7th in the world) can be among the top five customers of Shanghai Port, Ningbo Zhoushan Port and Qingdao Port.

It can also be seen from the figure that the port benefits from jointly operating terminals with shipping companies. Shipping companies often deploy a staggered development among multiple hub ports in a certain area. Among the top ten major ports, MSC’s share in the Port of Antwerp and Bruges is as high as 35.7%, which is larger than the proportion of capacity deployed by other shipping companies in various ports.

This is because MSC PSA Europe, a joint venture between MSC’s subsidiary TIL and PSA International The terminal is currently the largest container terminal in Europe, with a designed annual throughput of 9 million TEUs. COSCO Shipping has also become the second largest customer of the Antwerp-Bruges Port because of its equity interests in CSP Zeebrugge Terminal and Antwerp Terminal.

Looking at the Port of Singapore, its operator PSA International has joint venture terminals with MSC, CMA CGM, COSCO Shipping Lines and ONE, the top four customers of the Port of Singapore. Maersk (No. 2 in the world) without a terminal can only rank fifth. However, APMT, a subsidiary of Maersk, operates a terminal in the nearby Tanjung Pelepas Port. Maersk and its subsidiaries accounted for 56.6% of the capacity in the port, far exceeding the second place MSC (19.6%).

Port Klang, another important port in the region, has a different ranking of its main customers, namely CMA CGM (22.3%), COSCO Shipping Lines (14.1%) and Evergreen (10%). This phenomenon is also obvious in Northern Europe. Maersk is not even the top five customers of the Port of Hamburg, because its shipping capacity in Germany is deployed in Bremerhaven and Wilhelmshaven, and it has jointly owned terminals in these two ports.

In addition to the importance that shipping companies attach to ports, it is also worth looking at the dependence of large ports on large shipping companies. Among the top ten major ports, the top ten liner companies account for the lowest total capacity in Chinese ports, because in addition to participating in East-West trade, Chinese ports are also very active in domestic trade and intra-Asian trade, and many domestic trade and feeder shipping companies call Ships, and Shanghai Port (Jinjiang Shipping), Ningbo Zhoushan Port (Ningbo Ocean), Qingdao Port (Shandong Port Shipping Group) all have their own shipping companies to provide domestic and foreign trade feeder services.

North American ports have the highest dependence because their feeder networks are not strong enough. In the trans-Pacific route, Asia’s COSCO Shipping Lines and ONE are the first and fifth largest customers of the Port of Los Angeles and Long Beach respectively. In the trans-Atlantic route, European shipping companies Dominate. This actually reflects the fact that Asian shipping companies have deployed more fleets on the trans-Pacific route.

Of course, shipping companies will continue to compete in various ports, and hub ports will also actively attract “funders” who can bring large cargo volumes. Among them, MSC’s actions are the most obvious. For example, MSC’s share in Qingdao Port is only ranked fifth. When MSC CEO visited China this year, he signed a comprehensive cooperation framework agreement with Shandong Port Group. Since then, Qingdao Port has ushered in many projects. MSC large ships call at the route.

In Northern Europe, MSC has adopted a posture of “I want it all.” In addition to its huge advantages in the Port of Bruges in Antwerp, MSC is also cooperating with Hutchison Ports to build the largest automated terminal in Europe at the Port of Rotterdam and is acquiring the Port of Hamburg. Among the major carriers is HHLA.

If you are considering expanding into new markets, xcjd Ocean Shipping Services can help. As an experienced NVOCC, we will help you every step of the way with expert logistics knowledge, visibility and communication capabilities.