According to McKinsey data analysis, 90 million Indonesians will join the middle class or become consumer groups by 2030, making it the world’s largest new consumer market after China and India. The demographic dividend cannot be underestimated.Why is Indonesia known as one of the most difficult countries in the world to clear customs?

However, this vast untapped consumer market is also known as one of the most difficult countries in the world to clear customs!

Why is Indonesia known as one of the most difficult countries in the world to clear customs?

According to the most basic regulations, in order to import products into Indonesia, the required documents must first be submitted and verified by the General Administration of Customs, and the products may be subject to inspection. In addition, importers are required to fill out import declaration forms and declare to customs for all imported products. Importers must also apply for a Customs Identification Number (NIK) from the General Administration of Customs to comply with various customs regulations; in addition, they must also apply for an Import License (API) from the Ministry of Trade or the Bureau of Investment and Planning (BKPM) before they can import. product.

Most industries in Indonesia have industry standards. Indonesian National Standards (SNI) are national standards, formulated by the Indonesian National Standards Bureau and approved by the National Review Committee. All controlled products exported to Indonesia must have the (SNI marking) SNI mark, otherwise they cannot enter the Indonesian market. The currently regulated product range is divided into four categories: household electronics, telecommunications and IT equipment (46 items in total); building materials (8 items in total); automotive materials and parts (24 products in total); other commodities (such as footwear, Leather products, toys, clothes, etc., a total of 25 products).

All leather goods sent from abroad to Indonesia (INDONESIA) are required to provide the original Certificate of Origin and Certificate of Health along with the goods.

Cargo labeling regulations are issued by the Department of Trade. All imported consumer goods must be marked with the import agent, and product labels must be clearly written or printed in Indonesian, Arabic numerals and Latin letters. Unless there is no matching word in Indonesian, or the goods are exported, merchants must use the local Indonesian language, numbers and letters.

Food, beverages, ceramics, glassware, household products, textiles and soaps must be shipped in the original packaging of the manufacturer and packaged separately according to the type, performance and trademark of the goods. The type of goods must be clearly marked on the original packaging. , quantity, weight, trademark and other contents. In addition, special attention should be paid to waterproofing and rust prevention, taking into account the climate conditions in Indonesia.

China exports to Indonesia, which products are the most exported, such as:

General goods can be divided into: cloth, leather, curtains and accessories, plastic models, clothes hangers, plastic pipes; small commodities, stainless steel products (finished products, light goods), ordinary wooden doors (not logs),

ordinary furniture, ordinary kitchen utensils, hardware Accessories, aluminum tubes/aluminum materials, ordinary building materials, mobile phone cases, glass/tiles (wooden frame required), ordinary LED lamps, stainless steel tubes, books, glasses, ceramic bowls, ceramic bathroom ware; small accessories, ceramic tiles, clothes, shoes , bags, suitcases, daily necessities, hotel supplies, mobile phone accessories, car accessories, motorcycle accessories, molds, labor protection supplies, mice and keyboards, mahjong/mahjong machines, tires, wires and cables, small appliances (induction cookers, electric kettles, microwave ovens , fans, ovens, etc.), electronic products, walkie-talkies, shoes, air conditioners, refrigerators/freezers, TVs, large electrical appliances, fishing gear, desktop computers (unlicensed), children’s toys, clothes, machines (with wooden box packaging) beauty instruments, Precision instruments/devices, (machine goods need to provide relevant documents before they can be loaded into the container)

Sensitive goods can be divided into: electric vehicles, power banks, electric scooters, electric vehicles, dry batteries, lead-acid batteries, unbranded watches, food, food seasonings, granules, dried seafood products, beverages, facial masks, cosmetics, skin care products, baths Lotion/shampoo, dish soap, liquid, and masterbatch (plastic pellets) need to be confirmed separately.

Indonesian customs clearance

The current basic principle of import customs clearance in Indonesia is that shipments with a value of less than 100 US dollars are tax-free; shipments with a customs value of more than 100 US dollars and less than or equal to 1,500 US dollars can be subject to any of the following customs clearance procedures: Use the shipping receipt for customs clearance ( Single tariff of 7.5%) or customs clearance by submitting PIBK/PIB import declaration.

Indonesia’s tax marking will be implemented from November 30, 2022, and the Indonesian Customs and Excise Tax Agency is revising the regulations on the import and export documents and certification materials required for goods. The consignor must provide a tax number (NPWP) and indicate the purpose of shipment (such as sale, gift, replacement) on the import and export invoice. The shipper is also required to submit any additional supporting documentation that may apply to the shipment (e.g., proof of payment, sales order). Failure to comply with these requirements will result in shipment delays, fines, and/or detention by customs.

In addition, in Indonesia, customs is divided into red light customs and green light customs.

If you have business in Indonesia and need to frequently import goods to Indonesia, you may be most afraid of hearing the words “red light period”. Because it’s really, really troublesome!

If a certain kind of export goods encounters a customs red light period in Indonesia, the customs will pay more attention to protecting local companies that produce the goods. Then the export companies will encounter relatively strict customs measures when exporting goods to Indonesia.

Generally speaking, the period from December to March of the following year is the red light period for import customs clearance in Indonesia. Indonesian Customs will work with other law enforcement agencies to strictly inspect import customs clearance. Customs clearance procedures require more procedures and take longer than before. If not done properly, more fees will be incurred accordingly. Most goods are 100% inspected.

How to handle customs clearance of goods in Indonesia?

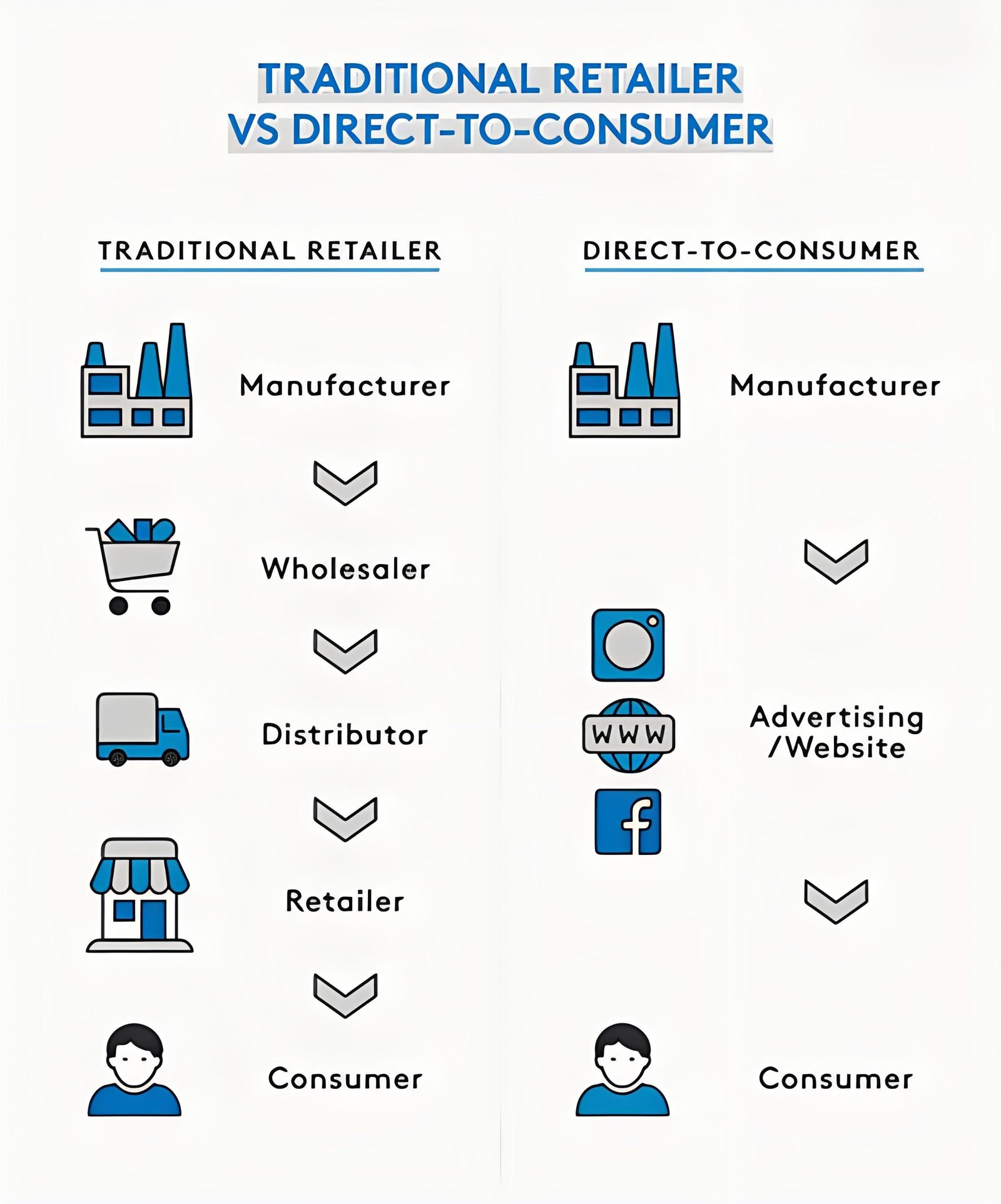

1) For different goods categories (each country may have different import requirements for different categories – tariff & non-tariff thresholds) and quantities, it is necessary to clarify the cargo information before shipment. Be sure to communicate with local Indonesian customers and local customs. What are the latest policies and whether such products will encounter customs clearance obstacles. It is best for him to find a powerful local agent at the destination port for customs clearance. For products exported to Indonesia, contracts should be signed with FOB prices as much as possible to avoid Indonesian customs clearance risks.

2) If the Indonesian customer does not have the corresponding import rights, or has the import rights but has shallow qualifications, it is generally easier to be inspected (obtaining the import license API, or even applying for the Master List, does not mean that customs clearance will be barrier-free). Therefore, DDP operation can be adopted, that is, some well-qualified import agents can be used to complete customs clearance.

For the XCJD sea freight line, it takes 15-20 days for general cargo to arrive at ports such as Jakarta/Surabaya/Semarang, 5-7 working days for customs clearance (depending on the speed of customs release), and 1-2 working days for delivery to the Jakarta area.

XCJD air freight line, general goods arrive in Jakarta in about 4-5 working days from the time of arrival.

3) I have to mention Indonesia’s FORM E (China-ASEAN Free Trade Area Preferential Certificate of Origin). This document has many requirements and is particularly stringent. For example: product name, cargo data, etc. must be very strict. Details, transportation route (in addition to the place of departure and destination, but also whether there is a transit port, etc.), whether the certificate of origin standards are consistent, invoice pricing method, invoice number and date, manufacturer information, and shipping mark information should be different from the actual goods. The marks on the packaging are exactly the same, etc. These are all very detailed things. All details must be checked with the customer. Otherwise, the certificate will be refunded and fined!

One thing to note in particular: If you are shipping by sea and transshipping from Hong Kong, you must declare the goods truthfully to the Hong Kong CCIC and apply for a non-reprocessing certificate. When declaring to Indonesian Customs, you must submit FORM E and this material at the same time.

If you have goods that need to be imported from China to Indonesia, you can contact us to make a transportation plan in advance to avoid delays due to customs clearance.